tax per mile pa

10 miles Always drive the limit I dont drive Vote. Doing some quick math at 81 cents per mile if you drive 12000 miles a year your annual vehicle mileage tax would by 972.

Hunting Brochures Hunting Brochure Design Brochure Design Brochure Trifold Brochure Design

260 per pack of 20 cigaretteslittle cigars 013 per stick Malt Beverage Tax.

. Previous Poll Results Next How far above the speed limit do you drive on the freeway. Charging Pennsylvania residents 81 cents per mile traveled is ridiculous especially with the quality of the roads. To put that in perspective model year 2020 light-duty vehicles cars pickups suvs and cargo vans average 257 miles per gallon meaning that an 81 cent per mile tax on the average 2020 car would be equivalent to a gas tax of 208 per gallonalmost four times the current state rate of 587 cents per gallon and over three times the nations.

If you are paid at a rate lower than the amount which is currently set at 445 than you may claim the difference but if you are paid at a higher amount then you may be subject to report the excess as wages earned. Pennsylvania has a flat income tax rate of 307 the lowest of all the states with a flat tax. PA Sales Use and Hotel Occupancy Tax.

Boesen noted that a proposal floated in Pennsylvania suggests using a tax of 81 cents for each mile traveled among. PennDOT relies on gas tax to fund 78 of its revenue needs far more than neighboring states. The commonwealth is joined by 16 other states as members of the Eastern Transportation Coalition.

You may only deduct those expenses actually paid while performing the duties of your employment Public transportation cost Commuting expenses. Its called a mileage-based user fee -- get rid of the gasoline tax altogether and replace it with a fee based on how many miles you drive. Pennsylvania vehicle mileage tax being discussed to replace lost gas tax revenue.

Additionally motorists nationwide pay a federal excise tax of 184 cents per gallon of gasoline a rate that has not changed since October of 1993. Electric Vehicle EV MBUF Pilot. Pennsylvanias per-gallon gas tax is higher than that of comparable states576 cents per gallon in Pennsylvania as compared to Delaware 23 cents Maryland 3949.

The Morning Call. With the miles-driven fee that driver would pay. The vehicle mileage tax is typically based on how many miles you drive in a particular time frame like a year or quarter.

With a state gasoline tax at 587 cents passenger vehicles drivers pay about 317 a year in state taxes. Pennsylvanias tax on gasoline is 587 cents per gallon 752 for diesel fuel. You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as a road user charge.

According to the report the commission wants to fill the bulk of Pennsylvanias more than 9 billion state-level transportation funding gap with the mileage tax. A mileage tax around the 45 cents per mile and repealing the. With a typical resident driving 12 to 15 thousand miles per year that would generate or if you.

WHTM Pennsylvania could get rid of the gas tax but drivers would still pay to hit the road. A special state transportation committee is recommending a per-mile tax and more tolling to replace Pennsylvanias gas tax. What is a mileage tax.

However 81 cents mile is very steep. A mileage tax seems reasonable. This is the maximum amount allowed as a deductible expense.

A mileage tax around the 45 cents per mile and repealing the. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

With major gas-powered automakers transition to manufacture electric vehicles by 2035 and people driving less during the pandemic PennDOT. The more you drive the more you pay. See Malt Beverage Tax Rate Table.

1 percent for Allegheny County 2 percent for Philadelphia. 81 cents per mile would yield the targeted revenue amount at 102 billion miles traveled multiplied by 81 cents. This tax may be as high as 81 cents per mile which is to compensate for lost revenue in fuel taxes.

Pennsylvania Unreimbursed Business Expenses Mileage Employee Business Deductions Not Allowed For Pennsylvania Tax Purposes Expenses based upon federal per-diem allowances. That puts Pennsylvania just behind California 669 and Illinois 5956. With that in mind the commission proposed phasing in over five years an 81-cent-per-mile user fee doubling the states vehicle registration.

No restriction on use. With the mileage tax those motorists would pay a little more than 1093. The mileage-based tax would be 81 cents per mile and would raise just shy of 9 billion a year when the system is established compared to the roughly 345 billion motor fuel taxes.

Mileage tax is a type of tax that is paid by the driver based on miles driven.

![]()

Pennsylvania Pipelines And Pollution Events Fractracker Alliance

French Neoclassical Continental Distress Painted Figural Etsy Distressed Painting Console Table Faux Marble

Gov Tom Wolf Seeks Overhaul Of Pennsylvania S Highway Funding Transport Topics

The Deadliest Roads In Pennsylvania Moneygeek Com

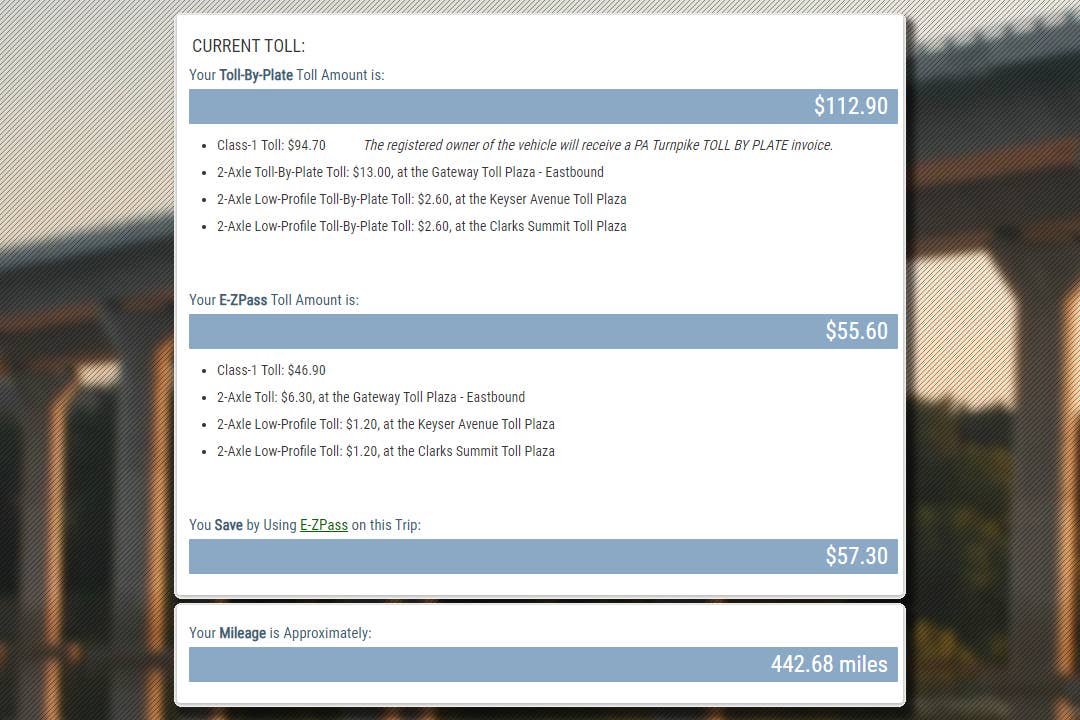

The Pennsylvania Turnpike Is The World S Most Expensive Toll Road Study

Since Ev Drivers Zip Past Gas Taxes They Don T Contribute To The Federal Fund For Road Maintenance A New Wor New Cars For Sale Economic Research Self Driving

Pennsylvania Gas Tax Is The Money Going Where It Should

Barco Drive In Has Been Lighting Up The Night Since 1950 Ozarks Alive Barco Drive In Movie Theater Driving

Pair Of Diamond Shaped Deep Wood Frame Gold Leaf Wall Mirrors Etsy Mirror Wall Diamond Shapes Gold Leaf

Silik Style Italian Baroque Rococo Dining Room Set By John Etsy Italian Baroque Hand Painted Chairs Distressed Painting

The Mile Level Pizza Sub Shop Home Bedford Pennsylvania Menu Prices Restaurant Reviews Facebook